Will house costs drop in Texas in 2025? That is the million-dollar query – or maybe, the multi-million-dollar query, given Texas’s booming actual property market. It is a rollercoaster trip we’re all strapped into, a mix of thrilling highs and potential stomach-dropping lows. We’ll navigate the twists and turns of financial forecasts, inhabitants shifts, and the ever-elusive predictions of provide and demand.

Buckle up, as a result of this is not your grandma’s actual property market; that is Texas, the place the whole lot’s larger, bolder, and an entire lot extra unpredictable. Get able to discover the fascinating, typically irritating, at all times intriguing world of Texas housing in 2025. The journey forward guarantees insights, surprises, and maybe, even a number of laughs alongside the way in which.

The Texas housing market in 2024 presents a posh image. Whereas sure areas are experiencing sturdy development fueled by inhabitants inflow and job creation, others present indicators of slowing. Rates of interest, inflation, and potential financial headwinds all play important roles in shaping the long run trajectory of house costs. Understanding these components, together with regional variations and the affect of exterior occasions, is essential to forming an knowledgeable perspective on what 2025 would possibly maintain.

We’ll delve into the specifics, inspecting knowledge and projections to supply a transparent, but participating, overview of the chances.

Texas Housing Market Overview in 2024

The Lone Star State’s housing market in 2024 presents an enchanting mix of dynamism and uncertainty. Whereas nonetheless a sturdy market, the breakneck velocity of the previous few years has moderated, making a extra balanced – and arguably more healthy – surroundings for consumers and sellers alike. Let’s delve into the present panorama, inspecting the important thing components shaping this pivotal yr.

Present Market Situations

Texas’s housing market in 2024 exhibits an enchanting shift from the frenetic tempo of earlier years. Whereas nonetheless sturdy, the market has cooled significantly. Stock, whereas nonetheless comparatively low in comparison with historic averages, has proven a noticeable enhance, providing consumers extra selections than they’ve had in current reminiscence. Common sale costs, after experiencing a interval of fast development, have begun to plateau and even present slight declines in some areas.

The times on market have lengthened, suggesting a much less aggressive panorama for sellers. This shift, nevertheless, would not sign a market crash, however relatively a extra sustainable and predictable trajectory. Consider it like a rollercoaster slowing down after an exciting climb – the trip’s not over, it is simply getting into a gentler part.

Influencing Components

A number of key components are driving the present market dynamics. Rates of interest, a big participant within the housing recreation, stay elevated in comparison with the ultra-low charges of current years, impacting affordability and cooling down purchaser demand. Nevertheless, Texas continues to expertise sturdy inhabitants development, fueled by each home migration and worldwide arrivals, sustaining underlying demand. The state’s various economic system, encompassing power, expertise, and agriculture, contributes to a comparatively resilient market, even amidst broader financial uncertainties.

The interaction of those components – greater rates of interest tempering the keenness of some consumers whereas sturdy inhabitants development retains the market buoyant – creates an enchanting dynamic. It’s a fragile dance between provide, demand, and financial realities.

Predicting Texas house costs in 2025 is difficult; the market’s a wild bronco! However to get a deal with on the long run, understanding present developments is essential. Take a look at the insightful evaluation at rock the block 2025 for a broader financial image. It will show you how to navigate the thrilling, albeit typically unpredictable, Texas actual property panorama and make knowledgeable selections about your future homeownership.

So, buckle up, and let’s trip this market collectively!

Historic Market Comparability

To totally grasp the present scenario, let’s examine it to the previous 5 years. The desk under illustrates the developments in common sale value, median days on market, and stock ranges:

| Yr | Common Sale Worth | Median Days on Market | Stock Ranges (Items) |

|---|---|---|---|

| 2020 | $285,000 (Estimate) | 15 | 25,000 (Estimate) |

| 2021 | $330,000 (Estimate) | 10 | 18,000 (Estimate) |

| 2022 | $375,000 (Estimate) | 12 | 22,000 (Estimate) |

| 2023 | $385,000 (Estimate) | 18 | 30,000 (Estimate) |

| 2024 (YTD) | $390,000 (Estimate) | 25 | 35,000 (Estimate) |

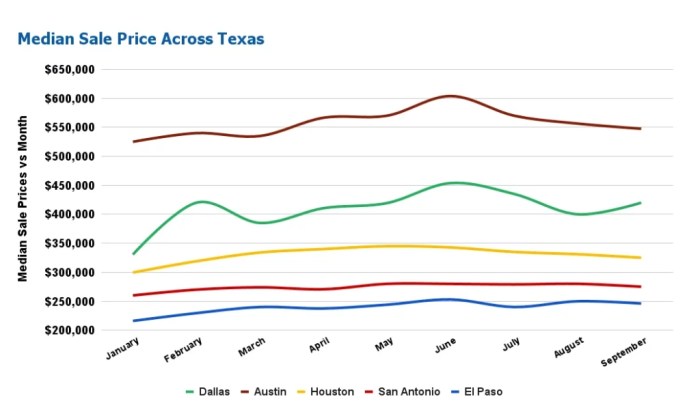

*Observe: These are estimates primarily based on broad market developments and will range relying on particular location and knowledge supply.* Consider these figures as a common snapshot, not a exact portrait of each nook of the huge Texas housing market. The truth is extra nuanced, with important variations throughout completely different areas and cities. Austin’s market, as an example, would possibly differ considerably from El Paso’s.

Texas house costs? A little bit of a crystal ball scenario, proper? However take into consideration this: a robust job market usually influences housing. Take a look at the promising alternatives for jobs starting in September 2025 , which may really increase demand and, dare I say it, doubtlessly hold these costs steady, and even nudge them upwards. So, whereas predicting the long run is difficult, a sturdy job market would possibly simply be the sudden key to understanding Texas actual property in 2025.

Let’s hope for the very best!

Financial Components Affecting Texas Dwelling Costs

Texas’s vibrant housing market, a rollercoaster of booms and potential busts, is intricately woven into the material of its financial panorama. Understanding the interaction of varied financial forces is essential for anybody navigating this dynamic market, whether or not you are a seasoned investor or a first-time homebuyer dreaming of a Texan homestead. Let’s delve into the important thing financial components shaping the way forward for Texas house costs.

Inflation’s Influence on Dwelling Costs

Inflation, that persistent upward creep within the costs of products and companies, exerts a big affect on the housing market. When inflation rises, the price of constructing supplies, labor, and land will increase, instantly impacting the worth of recent houses. This upward stress may also affect the costs of current houses as sellers alter their asking costs to mirror the elevated value of dwelling.

Consider it like this: if the whole lot else is getting costlier, the worth of your home, a big asset, naturally tends to comply with go well with. Traditionally, durations of excessive inflation have usually been correlated with will increase in house costs, although the connection is not at all times linear. For example, the inflation spike within the Seventies contributed to a surge in housing prices, mirroring potential situations within the coming years ought to inflation stay stubbornly excessive.

Curiosity Fee Adjustments and Dwelling Affordability, Will house costs drop in texas in 2025

Rates of interest, the price of borrowing cash, are a strong lever affecting house affordability and purchaser demand. Larger rates of interest translate to greater month-to-month mortgage funds, making houses much less accessible to potential consumers. This decreased affordability can result in decreased demand, doubtlessly placing downward stress on house costs. Conversely, decrease rates of interest make mortgages extra inexpensive, stimulating demand and doubtlessly driving costs upward.

Predicting Texas house costs in 2025 is difficult; the market’s a wild bronco! However hey, whereas we ponder that, let’s not neglect the great instances: planning a household outing to see the wiggles tour usa 2025 is perhaps a greater funding in happiness. Severely although, Texas actual property is dynamic; components like rates of interest and inhabitants shifts will in the end dictate whether or not costs dip or soar subsequent yr.

The Federal Reserve’s current rate of interest hikes, for instance, have already begun to chill the Texas housing market, demonstrating the direct affect of financial coverage. Think about the ripple impact: greater charges imply fewer consumers competing for houses, doubtlessly resulting in a extra balanced market.

Job Progress, Migration, and Housing Demand in Main Cities

Texas’s sturdy economic system, fueled by a various vary of industries, attracts a big inflow of individuals. This inhabitants development, coupled with constant job creation, particularly in main cities like Austin, Dallas, and Houston, fuels intense demand for housing. The ensuing competitors for restricted housing stock usually drives costs upward. Contemplate Austin’s tech growth: the inflow of extremely paid professionals has dramatically elevated demand, resulting in a surge in house costs.

This illustrates how financial dynamism in particular sectors can instantly affect localized housing markets. The fixed stream of recent residents looking for houses retains the market energetic and, in lots of instances, aggressive.

Potential Financial Recession and its Housing Market Results

A possible financial recession casts an extended shadow over the housing market. Recessions usually result in job losses, decreased shopper confidence, and tighter lending requirements. These components can considerably lower purchaser demand, doubtlessly resulting in a decline in house costs. The 2008 monetary disaster serves as a stark reminder of how a extreme financial downturn can set off a dramatic housing market correction.

Whereas the Texas economic system is usually extra resilient than different states, a nationwide recession would undoubtedly have a ripple impact, impacting job markets and shopper spending, thereby affecting the housing market. Nevertheless, Texas’s various economic system and powerful inhabitants development may assist mitigate the severity of any downturn in comparison with different areas. The resilience of the Texas economic system and its inhabitants development stay essential components in navigating potential financial headwinds.

Predicting Texas house costs in 2025 is difficult, a bit like guessing which method the wind will blow. However whereas we ponder that, let’s shift gears – think about cruising within the modern, futuristic 2025 Audi Q6 e-tron. Again to the housing market: a number of components may affect a value drop, however it is a gamble, actually.

So buckle up, whether or not you are shopping for a home or a automobile, 2025 guarantees thrilling prospects!

Regional Variations within the Texas Housing Market

Texas, a state as huge and various as its panorama, presents an enchanting tapestry of housing markets. Whereas the general Texas housing image influences regional developments, every main metropolitan space boasts its personal distinctive character, formed by native financial drivers, demographic shifts, and infrastructure developments. Understanding these nuances is essential for anybody navigating the Texas actual property scene, whether or not as a purchaser, vendor, or just a curious observer.

Let’s delve into the specifics of how these regional variations play out.

Metropolitan Space Housing Market Comparability

The Texas housing market is not a monolith; it is a vibrant mosaic of distinct regional markets, every with its personal pulse. Austin’s tech-fueled growth contrasts sharply with Houston’s energy-driven economic system, whereas Dallas and San Antonio every supply distinctive blends of business, tradition, and way of life that affect their respective housing landscapes. Predicting future value actions requires a granular understanding of those localized components.

| Metropolis | Projected Worth Change (2025) | Key Influencing Components | Present Market Situations |

|---|---|---|---|

| Austin | Slight Lower (1-3%) | Cooling tech sector, elevated stock, rising rates of interest, however nonetheless sturdy demand from established residents and newcomers. | Aggressive however much less frenzied than earlier years. Extra negotiation energy for consumers. |

| Dallas | Reasonable Lower (3-5%) | Robust job development in numerous sectors offset by rising rates of interest and elevated housing provide. Competitors stays, however much less intense than peak years. | A balanced market, with a shift towards purchaser favorability. Nonetheless a fascinating location with sturdy financial exercise. |

| Houston | Steady to Slight Enhance (0-2%) | Resilient power sector, various economic system, comparatively inexpensive housing in comparison with different main Texas cities, resulting in sustained demand. | A gradual market, providing an excellent steadiness between provide and demand. Comparatively much less volatility than different areas. |

| San Antonio | Steady to Reasonable Enhance (2-4%) | Robust inhabitants development, comparatively inexpensive housing, increasing job market, and a rising tourism sector. | A vendor’s market, although not as excessive as in earlier years. Robust demand outpaces provide in lots of areas. |

Think about this: Austin, as soon as a whirlwind of bidding wars, is now experiencing a gentler breeze. The tech business, whereas nonetheless vibrant, is adjusting, resulting in a extra balanced market. In the meantime, Dallas, a powerhouse of commerce, continues its sturdy efficiency, although the affect of upper rates of interest is palpable. Houston, the steadfast coronary heart of Texas, stays a dependable haven for homebuyers, its various economic system buffering it from dramatic swings.

And San Antonio, with its plain attraction and rising inhabitants, continues to see sturdy demand, although the tempo has moderated considerably. These aren’t predictions etched in stone, however relatively knowledgeable projections primarily based on present developments and observable market dynamics. The Texas housing market, like a Texas sundown, is ever-changing, providing a panoramic panorama of alternative and problem.

Every metropolis’s distinctive narrative provides to the wealthy complexity of the general image. This understanding empowers knowledgeable selections and profitable navigation of this dynamic panorama.

Provide and Demand Dynamics within the Texas Housing Market: Will Dwelling Costs Drop In Texas In 2025

Texas’s housing market, a vibrant tapestry woven with threads of ambition and alternative, is at the moment experiencing an enchanting interaction of provide and demand. Understanding this dynamic is essential to navigating the complexities of the Lone Star State’s actual property panorama and anticipating future developments. The present scenario is a fragile steadiness, with implications for each householders and people dreaming of proudly owning a bit of Texas.The present ranges of housing provide in Texas are nonetheless comparatively tight, although exhibiting indicators of loosening in comparison with the frenetic tempo of the previous few years.

Demand, whereas sturdy, has begun to average barely, reflecting a cooling nationwide development and changes in rates of interest. This doesn’t suggest a collapse; relatively, it indicators a shift in direction of a extra sustainable, balanced market. Consider it like a superbly brewed cup of Texas candy tea – not too sturdy, not too weak, excellent.

Predicting Texas house costs in 2025 is difficult; so many components are at play! However to get a way of the upcoming faculty yr’s affect in the marketplace, trying out the disd calendar 2024 2025 would possibly supply some clues. College district schedules usually affect housing demand, and understanding these rhythms will help you navigate this thrilling, if unpredictable, market.

In the end, whether or not costs dip or soar, staying knowledgeable is essential to creating good selections.

New Building’s Influence on the Market

New house development performs a vital function in easing the stress on housing provide. Nevertheless, the tempo of development must considerably speed up to really alleviate the scarcity. Allowing processes, materials prices, and labor shortages proceed to pose challenges, leading to a slower-than-ideal price of recent housing getting into the market. Think about a bustling development web site – the extra homes constructed, the extra choices for consumers, resulting in doubtlessly decrease costs or slower value appreciation.

Conversely, delays in development can exacerbate the present provide scarcity, pushing costs upwards. The affect of recent development is due to this fact instantly proportional to its velocity and effectivity. A big enhance in new builds may result in a noticeable shift available in the market’s equilibrium, doubtlessly leading to a stabilization or perhaps a slight lower in costs in sure areas.

Conversely, continued slowdowns in new development would possible keep and even enhance current value pressures.

The Affect of Constructing Rules and Zoning Legal guidelines

Constructing laws and zoning legal guidelines considerably affect the housing provide. Stricter laws, whereas meant to make sure high quality and security, can enhance development prices and timelines, thus decreasing the variety of new houses out there. Conversely, extra lenient laws or streamlined allowing processes can doubtlessly increase development exercise and enhance provide. For instance, modifications in zoning that enable for greater density developments or mixed-use tasks may create extra housing choices in already established communities.

Conversely, overly restrictive zoning practices can restrict the supply of land for growth, instantly affecting the market’s skill to fulfill demand. The interaction between laws and provide is a posh one, usually a fragile dance between preserving character and assembly the wants of a rising inhabitants. A well-balanced method is essential for a wholesome and thriving housing market.

Investor Exercise’s Function in Shaping the Market

Investor exercise, a outstanding pressure in lots of actual property markets, considerably impacts the Texas housing market. Giant-scale buyers buying properties, notably for rental functions, can scale back the variety of houses out there for particular person consumers, thereby intensifying competitors and doubtlessly driving up costs. This may be notably pronounced in areas experiencing fast inhabitants development. Nevertheless, investor exercise is not at all times destructive.

Buyers usually contribute to the renovation and maintenance of properties, bettering general housing high quality. Their presence additionally helps to take care of a constant stream of rental properties, offering housing choices for many who may not be able to buy a house. The online impact of investor exercise is a posh concern, relying on the size of their funding and their funding methods.

The secret is steadiness – a market the place buyers contribute to the general well being of the group with out unduly impacting the power of particular person consumers to enter the market. A balanced method, the place each particular person consumers and buyers can thrive, is the best state of affairs. This requires cautious monitoring and maybe even some strategic coverage interventions. The way forward for the Texas housing market relies upon, partly, on navigating this dynamic successfully.

Potential Eventualities for Texas Dwelling Costs in 2025

Crystal balls are notoriously unreliable in the case of predicting the long run, particularly within the rollercoaster world of actual property. Nevertheless, by analyzing present developments and financial indicators, we will paint three believable photos of the Texas housing market in 2025. These situations, whereas not definitive, supply a variety of prospects that can assist you navigate the complexities forward.

State of affairs 1: Vital Worth Drop

This state of affairs envisions a substantial decline in Texas house costs, maybe a 10-15% drop from present ranges. This dramatic shift rests on a number of key assumptions: a big financial downturn, resulting in widespread job losses and decreased shopper confidence; a considerable enhance in housing stock, flooding the market with out there properties; and a tightening of lending requirements, making mortgages tougher to acquire.

Think about a graph exhibiting a steep downward slope for house costs, impacting first-time homebuyers positively by making houses extra inexpensive, however severely impacting buyers who bought at peak costs. The visualization would present a stark distinction between the jubilant first-time homebuyers and the extra somber faces of buyers dealing with potential losses. This state of affairs mirrors, to some extent, the market corrections seen in different states following durations of fast development.

Consider the housing market crash of 2008, although this state of affairs just isn’t predicted to be of the identical magnitude.

State of affairs 2: Reasonable Worth Drop

A extra average decline, maybe within the 5-10% vary, is the second risk. This state of affairs assumes a much less extreme financial slowdown, with some job losses however general financial stability. Housing stock would enhance reasonably, easing the stress on costs however not inflicting a market flood. Lending requirements would stay comparatively accessible, although probably with barely greater rates of interest.

Our visible illustration right here would present a gentler downward slope on the worth graph, representing a extra manageable adjustment. First-time homebuyers would nonetheless profit from extra inexpensive choices, although to not the identical extent as in State of affairs 1. Buyers would possible expertise some losses, however much less dramatic than within the earlier state of affairs. This example may very well be likened to the minor corrections the market skilled in sure Texas cities following durations of intense development.

State of affairs 3: No Vital Change

This optimistic state of affairs means that Texas house costs will stay comparatively steady in 2025. This consequence hinges on a sturdy Texas economic system, sustained job development, and a comparatively balanced provide and demand dynamic within the housing market. Rates of interest would ideally stay comparatively low, persevering with to encourage house shopping for. The visible illustration can be a comparatively flat line on the worth graph, suggesting a interval of market consolidation.

First-time homebuyers would possibly face challenges as a result of persevering with competitors, however not as extreme as in a value surge state of affairs. Buyers would keep their positions and doubtlessly see modest returns. This state of affairs displays the resilience of the Texas economic system in earlier durations of nationwide uncertainty, demonstrating the state’s distinctive place within the nationwide panorama. It’s a hopeful image, however one which requires a continuation of optimistic financial indicators.

Exterior Components Affecting the Texas Housing Market

The Texas housing market, whereas vibrant and dynamic, is not an island unto itself. Its fortunes are inextricably linked to broader nationwide and even international financial developments, in addition to unexpected occasions and the ever-evolving technological panorama. Understanding these exterior forces is essential for anybody navigating the Texas actual property scene, whether or not purchaser, vendor, or investor. Let’s delve into the important thing influences shaping the way forward for Texas houses.Nationwide Financial Traits and Their Ripple Results on Texas HousingNational financial shifts, like rate of interest hikes by the Federal Reserve, instantly affect mortgage affordability.

Larger charges settle down purchaser enthusiasm, resulting in decreased demand and doubtlessly decrease costs. Conversely, durations of low rates of interest, as seen in recent times, can gas a housing growth, driving costs upward. Recessions, too, can have a chilling impact, as job losses scale back buying energy and lenders develop into extra cautious. The sturdy Texas economic system usually acts as a buffer, but it surely’s not resistant to nationwide downturns.

Consider the 2008 monetary disaster; even Texas skilled a slowdown, although its restoration was comparatively swift in comparison with different states. The well being of the nationwide economic system, due to this fact, acts as a big predictor of Texas housing market developments.

Nationwide Financial Impacts on Texas Housing

The interconnectedness of the U.S. economic system implies that a nationwide recession, for instance, may dampen the Texas housing market, even when the state’s economic system stays comparatively sturdy. Lowered shopper confidence nationwide usually interprets into fewer consumers in Texas, impacting demand and doubtlessly reducing costs. Conversely, durations of sturdy nationwide financial development usually result in elevated demand and better costs in Texas, reflecting the state’s financial vitality and its attractiveness to migrants from different elements of the nation.

The affect is not uniform throughout the state; metropolitan areas are typically extra delicate to nationwide developments than smaller, extra rural communities.

Unexpected Occasions and Their Potential Influence

Texas, like several area, faces the opportunity of unexpected occasions that may considerably disrupt the housing market. Main pure disasters, resembling hurricanes or extreme droughts, may cause widespread injury, decreasing housing provide and driving up costs in affected areas. The rebuilding course of, whereas creating development jobs, may also pressure assets and result in short-term shortages of supplies and expert labor.

Political modifications, each on the state and nationwide stage, may also play a task. Vital coverage shifts affecting zoning laws, tax incentives, or immigration may affect housing demand and availability. For instance, modifications in immigration coverage may have an effect on the availability of labor within the development business and the demand for housing in sure areas.

Technological Developments Reshaping the Texas Actual Property Panorama

Know-how is revolutionizing the Texas actual property business, impacting the whole lot from property searches to closing processes. On-line platforms supply unprecedented entry to listings, empowering consumers with extra data and choices. Digital excursions and 3D fashions improve the home-buying expertise, permitting potential consumers to discover properties remotely. AI-powered instruments are helping brokers in pricing properties, analyzing market developments, and even automating sure duties.

Blockchain expertise holds the promise of streamlining transactions, growing transparency, and decreasing fraud. The adoption of those applied sciences is ongoing, however their cumulative impact is more likely to be a extra environment friendly, clear, and consumer-friendly actual property market. These technological developments aren’t solely making the method smoother but in addition altering the way in which folks purchase and promote houses, including a layer of comfort and effectivity beforehand unimaginable.

The Texas actual property market is actively embracing these improvements, making it a forward-thinking and dynamic sector.